We all know how well Motherson Sumi (MSSL) has rewarded it’s long term investors. A magnificent 22X in last 15 years in a cyclical industry like Auto components. Between MSSL & Advanced Enzymes Technologies Limited (AETL), I see stark similarities, which I will detail in the end. Let us start with AETL background first:

Background

The journey began in 1957, when the founder Late L. C. Rathi pioneered the extraction of papain, an enzyme complex derived from papaya fruit and widely used for pharmaceutical and medical purposes. He went on to set up India’s first enzyme manufacturing plant in 1958.

1982 : Started as Advanced Biochemicals Private Limited

2011 : Acquired Cal-India Foods International for direct presence in USA

2012: Acquired AST Enzymes for consolidating USA presence

2016: IPO & listing on the Indian Stock Exchanges

2016:Acquired JC Biotech( a leader in Pharma Enzyme with a fermentation facility at Andhra Pradesh )

2017: Acquired Germany based Evoxx Technologies GmbH

Interestingly papaian was Biocon ltd’s first product which was launched in 1978.

Management

- Promoters have cumulative 7 decades of experience in Enzyme

- Head of R&D, CFO long associated for 18+ years

- Promoters own 58.13% of shareholding with no Share Pledge

Marquee Investor Profile

1.Orbimed:

World’s leading investment firm dedicated to health care with more than $14 billion assets under management . It owns 11% stake+ Board Seat in AETL

2.Nalanda Capital:

Nalanda invests primarily in those situations where it can be an active partner with the management team . They have recently bought ~ 4% stakes in AETL

Business Model

Revenue Mix

As on Q1 FY21

R&D Focus

Good Capital allocation Strategy

The company have been a good capital allocator with one of the last 2 acquisition have become profitable unit from loss making unit and JC biotech has started increasing its profitability

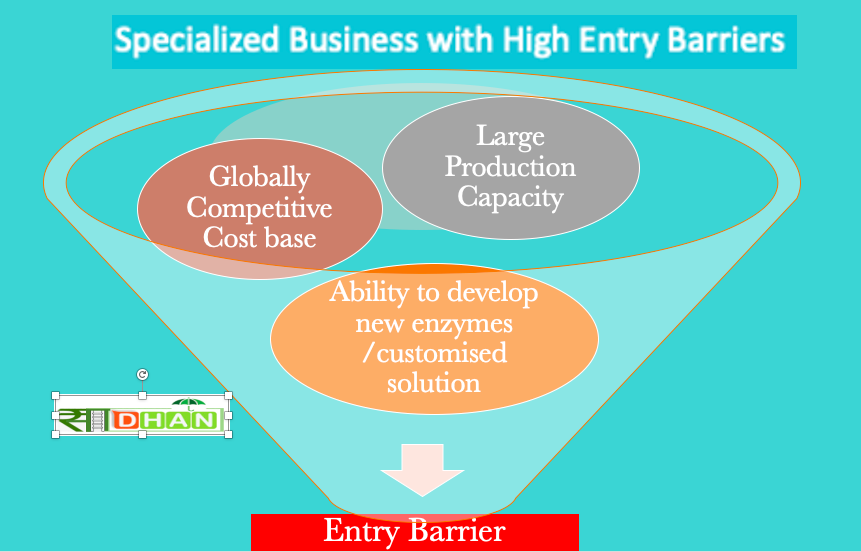

Moat

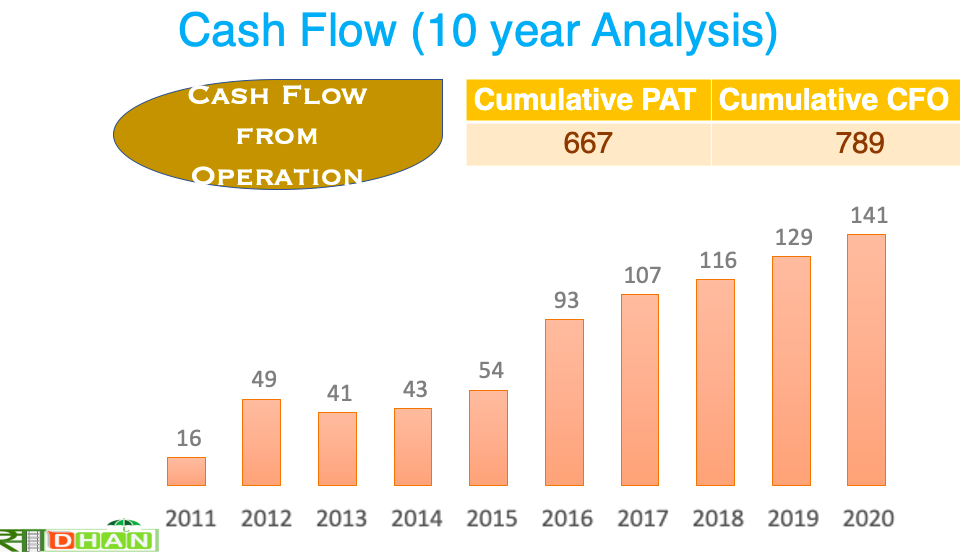

Financial Analysis

Peer Comparison

Only 2 listed players are there in Enzyme market so comparison with novozyme (the market leader with 48% market size) is as below:

Growth Drivers : AETL

•The Company operating at 50% plant utilization factor

•Without any fixed asset capacity addition it can grow top line till Rs 1200 cr

•The company need to invest into maintenance capex & R&D only, so the company can grow without debt till next 4-5 years

SWOT Analysis

Valuation

A high margin growing debt free business with high barrier to entry

Stock is relatively undervalued

Stock has great potential so people with conviction in Enzyme growth story should invest

Bonus Watch

Watch a video explaining this stock in much great depth below:

Similarities with Motherson Sumi

The company resembles in the following areas with Motherson Sumi:

Only time will tell whether the Company can grow like MSSL did in last decade , however one plus with this company is that the company is not a cyclical industry player but a niche player in a growing quasi commodity industry.